If you’re thinking about buying a home but aren’t sure if you’re ready to be a homeowner, it’s important to know if you’re ready for the responsibilities that come with it. Buying a home is one of the biggest purchases of your life so it’s important to consider all aspects of homeownership before diving in headfirst. For example, have you saved up enough for a down payment?

Are there any other financial obligations like student loans or credit card debt that need to be addressed first? Do you have enough cash flow to cover expenses like utility bills and maintenance costs? The purpose of this post is to help you answer these questions so that when you do decide to buy a home, you know everything possible about what it’ll take to become an owner!

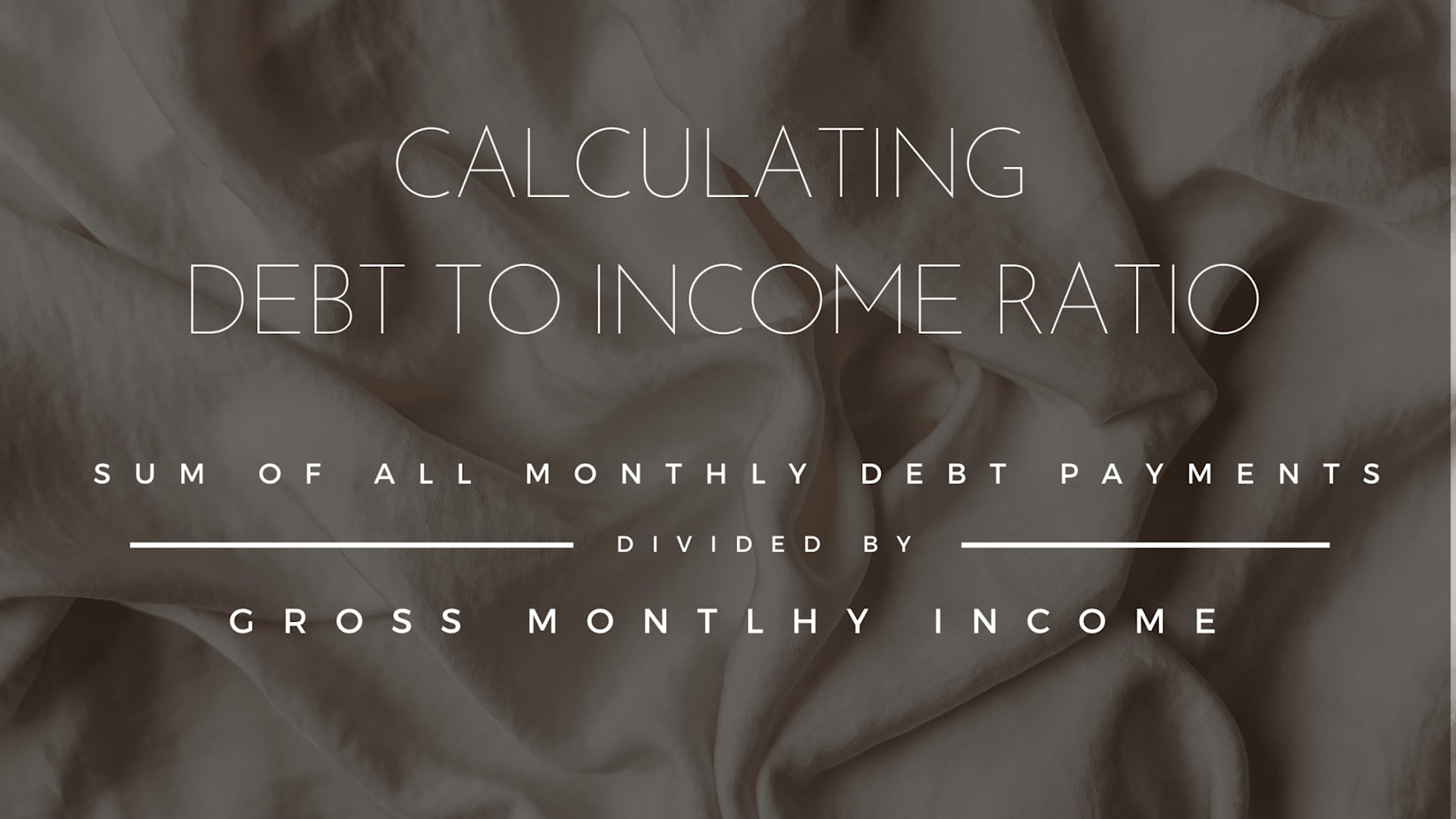

Debt-to-Income Ratio

First and foremost, lenders will look at your income when determining how much they’ll lend you for a mortgage loan. Lenders use what’s called a “debt-to-income ratio” (or DTI) to calculate this number which simply means – how much money goes towards paying off loans versus other expenses each month.

You should be able to tell if your debt is under control by looking at the ratio of your income to your debt. You can find this out by dividing the amount of money you spend on debt each month by how much you make in a year. If this number is greater than 35%, it means that more than one third of your total annual income goes toward paying off debts every year. This is not ideal, as it might make it difficult for you to get approved for a mortgage loan or refinance later down the line when interest rates go up.

Credit Score

Next up are credit scores (a measure of reliability). The higher your score is, the more likely it is that a lender will approve your application for credit at favorable terms—like lower interest rates on your loan. You need to have a credit score of 620 or above in order to qualify for most mortgages, so it’s worth checking yours before starting the process. The easiest way is by signing up for free on

CreditKarma—you’ll get an overall report about how your scores are doing and any recommendations on how you can improve them (in case your credit score isn’t already at the minimum).

If there’s anything that could potentially hurt your chances of getting approved for a loan, such as late payments or high balances, now would be the time to address it with your lender.

How much you can afford vs. how much you’re willing to pay

How much you can afford versus how much you are willing to pay monthly are a bit different. You should feel comfortable with your monthly payment even if the bank allows you to borrow more than you had anticipated – follow your gut. You know your finances better than any bank out there.

Start with one of these two questions: “How much do I pay each month on rent?” or “What is my monthly mortgage payment?” If those numbers aren’t within reach of what your income allows, consider lowering your expectations. Maybe lowering your purchase price or getting a roommate to help with the monthly mortgage payment.

If they are within reach, move on to calculating how much money will be coming off the top every month once taxes and insurance are factored in. This includes getting estimates from an insurance agent or tax professional; they’ll tell you exactly how much their services will cost before they actually charge anything so there won’t be any surprises down the road.

Savings is key

Finally there’s savings!

When it comes to buying a home, you should have enough money saved to cover your down payment and closing costs (2-4% of purchase price) and still have enough left over to cover six months worth of expenses. This is very important and often overlooked because homeowners often face

unexpected costs such as plumbing repairs or new appliances—and if you don’t have an emergency fund, these unforeseen expenses could put you at risk of going into debt.

Having an emergency fund is essential for any homeowner because there are lots of things that can go wrong in the years that follow your purchase. A few examples: maybe your washing machine breaks down, or maybe a pipe bursts under the kitchen sink due to freezing temperatures outside. These types of unexpected incidents can easily add up to thousands of dollars, and if your finances aren’t solid enough, they could force you into debt just when you had planned on moving forward with your life after purchasing a home!

Buying a home is a big decision, and it’s important to step back and seriously consider whether you’re truly ready. It’s not something that should be rushed – and if you find yourself overthinking over whether or not a home is the right move for you, maybe consider taking a step back and reevaluating. This should be fun and exciting! Fortunately, there are plenty of resources available to help you make this decision in an informed way and with a trusted real estate advisor by your side, you’ll have all the help you need.

Lets connect!